Hardly any aspect of American life wastes more time and resources than the efforts of

her millions of citizens who try to conform to - or not violate - the huge, inscrutible mass

of Internal Revenue Service Rules & Regulations.

While some say that the 16th Amendment [which supposedly enabled the Federal Income tax] was

never properly ratified [and

therefore void], one would be a fool to not dutifully file their

annual IRS return - to do so would result in drawing an instant Go Directly To Jail card. There is more

16th Amendment info here.

Some folks - most notably Steve Forbes and Glenn Beck - advocate what they call a Flat Tax as a

replacement for the IRS and all its rules and regulations. At least

it's fairly simple: declare your income and send in some percentage

of it (Steve favors 17%) to the

Federal Government. Simple indeed, but there are some serious caveats:

Exactly what is "income" and how is it to be calculated? What about illegal income, pension income, deductions from income, etc, etc ?? This absolutely suggests an immediate creation of new Flat Tax laws regarding the definition of, deductions from, and exemptions to, "income." Some will immediately say it is wrong that poor folks must pay the same tax rate as "the rich." These privileged fortunates must be made to pay their fair share.

In only a few years, various lobbying groups would have manipulated Congress into carving out more and more special deals - just like they have done to the present IRS Tax Code. Oh, and how about when the politicians want to push through a "temporary increase" in the flat tax rate to "fix the bridges" or "for the children"?

The Flat Tax is not quite so simple after all...Don't fall for it !!

I personally favor:

- Abandoning and disbanding the IRS, and all its associated regulations, and substituting in their place a

- National Sales Tax ("NST"). The NST is also known as the Fair Tax.

A VAT is deceivingly described by the government as 'a form of sales tax,' while in fact the VAT is applied at every layer of production as "value" is "added." This scheme results in multiple layers of taxation upon the same item which invisibly becomes part of the sales price.Typically there are three distinct layers: manufacturer, distributor, and retailer. Final sales price at the retail cash register adds a third VAT tax on top of the two prior, and invisible, VATs that had been added at the manufacturer and distributor levels. This invisibility is why governments favor the VAT, and why you should oppose it. Compare these examples of a 15% VAT vs a 25% NST:

15% VAT: You pay $33 in tax

NOTE: In the two tables above,25% NST: You pay only $20 - and no IRS

LAYER COST 20% Gross Profit 25% FAIR TAX Total Price Manufacturer $50.00 (included) $0.00 $50.00 Distributor $50.00 $12.50 $0.00 $62.50 Retailer $62.50 $15.63 $19.53 $97.66 ... NST

FAIR TAXTOTAL TAX $19.53 ... ... ... % of Retail Price: 20.00% ... "20% Gross Profit" = (0.20 * (Total Price - Taxes)) "Tax" = (Rate * ("Cost" + "Gross Profit")) Use of a "really high" 25% NST Rate, and a much "lower" 15% VAT rate in the above examples

is to illustrate how even a huge NST % would result in lower prices to the consumer than a VAT.

A true National Sales Tax is added only once - at the point of final sale to the consumer.

The National Sales Tax is also known as The Fair Tax. Deeper current analysis by the Cato Institute suggests that a 15% Fair Tax rate would provide about the same tax revenue to the Federal Government as the present IRS system - more perhaps due to the savings in bureacracy-cost when the IRS is disbanded.

BEWARE: Do not ever (repeat: NOT ever - never, no way) allow adding a National Sales Tax and/or a Value Added Tax ("VAT") and/or still more new taxes to the existing Federal income (and other) taxes.

The NST is a consumption tax, the nature of which includes the following advantages:

- No more IRS and no more Federal Income Tax.

- Earn $1,000 in pay, and take home a $1,000 paycheck (less the usual Social Security, Medicare, 0bamaCare, and State taxes).

- No more IRS forms to fill out - no more trying to live ones private and business life based on minimizing adverse tax consequences - ever!

- Interest on Savings, CDs, IRA accounts, etc. would not be subject to Federal Income Taxes.

- Social Security income would not be subject to Federal Income Taxes.

- Anyone can give themselves an instant tax break by lowering their spending for a while.

- Unlike the VAT, the NST can not be hidden by government(s) to be invisibly passed on to consumers.

- The "need" for Corporate Income Tax will disappear. Because CIT is always passed down to the final consumer (you and me), prices for the items we buy will go down when the CIT is abandoned.

- The rich spend way more than the rest of us, and so therefore "the rich" will pay their fair share of the Fair Tax too.

- United Nations staff, all other foreign residents, plus foreign tourists would also pay NST tax (about time, too). Under the IRS system, they now get off scott-free.

- Persons making "under the table" transactions (e.g., cash, barter, etc) will eventually pay their fair shares of NST - like every time they bought something at a traditional sales counter.

- Every time some rich Arab Oil Sheik buys a 500-million-dollar custom Boeing 767, or a Cadillac Escalade, they'll pay the full NST as well. Get the picture now ???

- Because no one has to declare (or hide) any "income", or fill out a Tax Return, 100% of illegal aliens, drug dealers, and all other criminals - even terrorists - would also be paying their fair shares of NST every time they purchased anything.

Detractors of the NST claim that it is "unfair to seniors" because seniors have paid income taxes all their lives and that, now lacking income, adding a NST would quickly erode their retirement savings.In response I posit that:

All the NST advantages above would apply equally to seniors. With a NST, IRA withdrawls would not be subject to IRS Income Taxes (IRS disbanded). A huge amount of retirement savings resides in IRA accounts for which taxes have yet to be (i.e., were never) paid, and The greatest unfairness to everyone is the ever increasing erosion of savings and purchasing power of these IRA cash and near-cash assets. This includes stocks and bonds, too. Why? Because their "values" are all being measured by a false and slippery standard: the US DildoDollar.

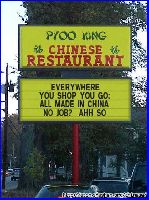

The erosion of savings is mainly caused by government deficit spending, trade deficits ("Made in China"), and the inevitable inflation (rising prices caused by devaluation of the US Dollar) that follows.Americans have traditionally valued services and goods by their prices in US Dollars. That was useful when there was a "gold standard" that backed our currency. During the 1930s Franklin D. Roosevelt dropped gold as the backing standard for the US dollar and it soon became as flexible in "value" as a proctologists exam glove.

"Quantitative Easing" = Fed "prints" money from thin air to buy US Bonds because Chinese won't any more. This Fed "money from thin air" is "spent" in a process known as "Monetizing The Debt" "Dollar Appreciation" = Devaluation of the US Dollar thanks to QE & Deficit Spending. "Gold Goes Up" = US Dollar is going down. "Oil & Gasoline Goes Up" = US Dollar is going down. "Food Goes Up" = US Dollar is going down. "Wal-Mart Prices Go Up" = US Dollar is going down.

The wanton spending of the 0mamba/Reid/Pelosi and Bush regimes has propelled our nation into a new round of stretching. Today we can "hear" and "feel" those ominous snapping sounds throughout our economy.

Is the "price" of everything - Oil, groceries, gold - really going UP??

Nay - it is the value of the US Dollar that is going DOWN !!

Here is probably THE BEST review of the advantages, and necessary details, of implementing an NST I have seen. Please read it carefully.Here's a good summary of the article at the link immediately above:

It is important to distinguish between tax-inclusive and tax-exclusive rates. The income tax and the flat tax are imposed on a tax-inclusive basis while traditional sales taxes are imposed on a tax-exclusive basis. Let us take as an example... assume someone who earns $100, pays $20 in taxes (whether an income tax, a flat tax, or a sales tax), and spends the remaining $80 on a CD player. Is the tax rate 20 percent or 25 percent? Both the income tax and the flat tax would be imposed on the $100 and thus the rate is 20 percent (i.e., 20/100 = 20%). The flat tax and income tax base are [both of the] tax inclusive [variety]. Traditional state sales taxes are imposed on the after-tax or tax-exclusive base. Thus, we typically would say that the sales tax rate needed to raise $20 is 25 percent (i.e., 20/80 = 25%). In each case the government is extracting the same resources [your tax bill] from the economy. Thus, to compare apples to apples, the sales tax rate that is comparable to the income tax rate or the flat tax rate is the tax-inclusive rate [i.e., 25%]. The 15 percent rate [is] proposed in this analysis [, which] is the tax-inclusive rate.There you have it: A 15% rate for the NST which generates the same tax revenue as the current IRS laws and taxes. Again, you are urged to read carefully this article (same as the link above) on implementing an NST. Please read it carefully. It is fully documented with tables and statistics which support the sufficiency of the 15% rate for the NST.

IN ADDTION to the NST, I also advocate a complete return to the original, and Constitutional imposition of National Tariffs on all imported goods. This means that NAFTA, CAFTA, and all similar, foreign gravy-trains be abolished. This would also have the beneficial effect of favoring American Jobs and American-made goods over their foreign counterparts.

This link goes to a 100K .pdf file that supports the view that "goods, wares and merchandise" imported into our country by foreign nations should be the entire basis of all United States Federal Revenue. Very good reading...Here are other related links:

Why an Income Tax is Not Necessary to fund the Federal Government.

Beware of Alternative Tax Plans.

Abolish the Federal Reserve System

Even More Federal Reserve Info

Federal Income Taxes Are Obsolete

Fabian's Fabulous Money Machine

This is a complex subject, and the reader is advised to do further research on all the various aspects of its component parts. Form your own opinion based on the best facts available, not the highly spun propaganda spoon fed by the media. The worst thing one can do is to do nothing. Hold your elected public officials fully accountable. It is also essential that you become familiar with the history and practices of a private organization that has been referred-to as the greatest swindle ever perpetrated upon the American people:

The Federal Reserve System, also discussed at this informative link.

Complete your outrage by a long, slow look at the

National Debt Clock.

Gasp at the

Current National Debt.

CURRENT:

0bama Dis-Approval Rating

CURRENT:

Congress Dis-Approval Rating

Charles Krauthammer has this to say about 0bama and his plans for fundamentally transforming your future:

Article 1 (massive new taxes), and

Article 2 (imposing a VAT).

Wikipedia has much more info on the VAT here.